What is Form 26AS, How to view and download Form 26AS

The due date of filing income tax return for FY 2016-17 (AY 2017-18) is 31st July 2017. Your Form 26AS is one of the most important documents required while filing income tax return. Form 26AS is your tax credit statement which shows all taxes received by the Income Tax Department against your PAN number during the financial year. Let's see what all details this form contains and how to view and download Form 26AS.

What is Form 26AS

Form 26AS is the annual consolidated tax credit statement issued to PAN holders. This statement shows all the taxes received by the Income Tax Department against the PAN of the tax-payer during the financial year. It includes details of all the taxes deducted on your income by your employer, bank etc. Form 26AS statement contains the following details.

1. Details of the tax deducted at source.

2. Details of the advance tax or self-assessment tax paid.

3. Details of the tax collected at source.

4. Details of the refund received from tax department during the financial year.

5. Details of Annual Information Return (Details of high-value transactions).

Therefore, always verify your Form 26AS for any discrepancies before filing your income tax return for the year.

How to view and download Form 26AS

There are two ways to access Form 26AS.

1. View and download Form 26AS through the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website.

2. View through Net Banking facility of authorized banks.

View and download Form 26AS through the TRACES website

Step by step instructions to view and download Form 26AS from TRACES website.

Step 1

Go to the income tax department’s e-filing website www.incometaxindiaefiling.gov.in and login using your login Id and password. If you do not have an account, you will have to register yourself on the income tax department's website (www.incometaxindiaefiling.gov.in). You have to fill your PAN number, name, and date of birth and choose a password. Once your registration is complete, you can login to your account with your user ID and password. Your permanent account number will be your user ID.

Go to “My Account” and click on “View Form 26AS (Tax Credit)” in the drop-down menu.

Click on “Confirm” button so that you will be redirected to the TDS-CPC (TRACES) website to view Form 26AS (Tax Credit Statement).

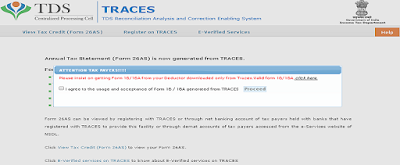

Now you are on TDS-CPC (TRACES) website. Select the small box to agree to the usage and acceptance of Form 16 / 16A generated from TRACES. Click on “Proceed” button.

Now click on the View Tax Credit (Form 26AS) link at the bottom of the page to view your Form 26AS.

Choose the year for which you want to view/download your Form 26AS under the “Assessment Year” drop-down menu. Choose the file format in which you want to view your Form 26AS under the “View As” drop down menu. If you want to see it online, choose the file format as HTML. If you want to download the Form 26AS, choose PDF. After choosing the file format, enter the “Verification Code” and click on “View / Download”.

To open the downloaded document you will require to enter a password. The password for your Form 26AS is your date of birth in DDMMYYYY format.

View Form 26AS through Net Banking of your bank account

You can also view your Form 26AS (Tax Credit Statement) through Net Banking facility. However, you can view your Form 26AS using this facility if your PAN number is linked to your bank account. This facility is available free of cost but only select banks are authorized to provide Form 26AS.

No comments:

Post a Comment